Rebates

What is the Inflation Reduction Act?

And what does it mean for you?

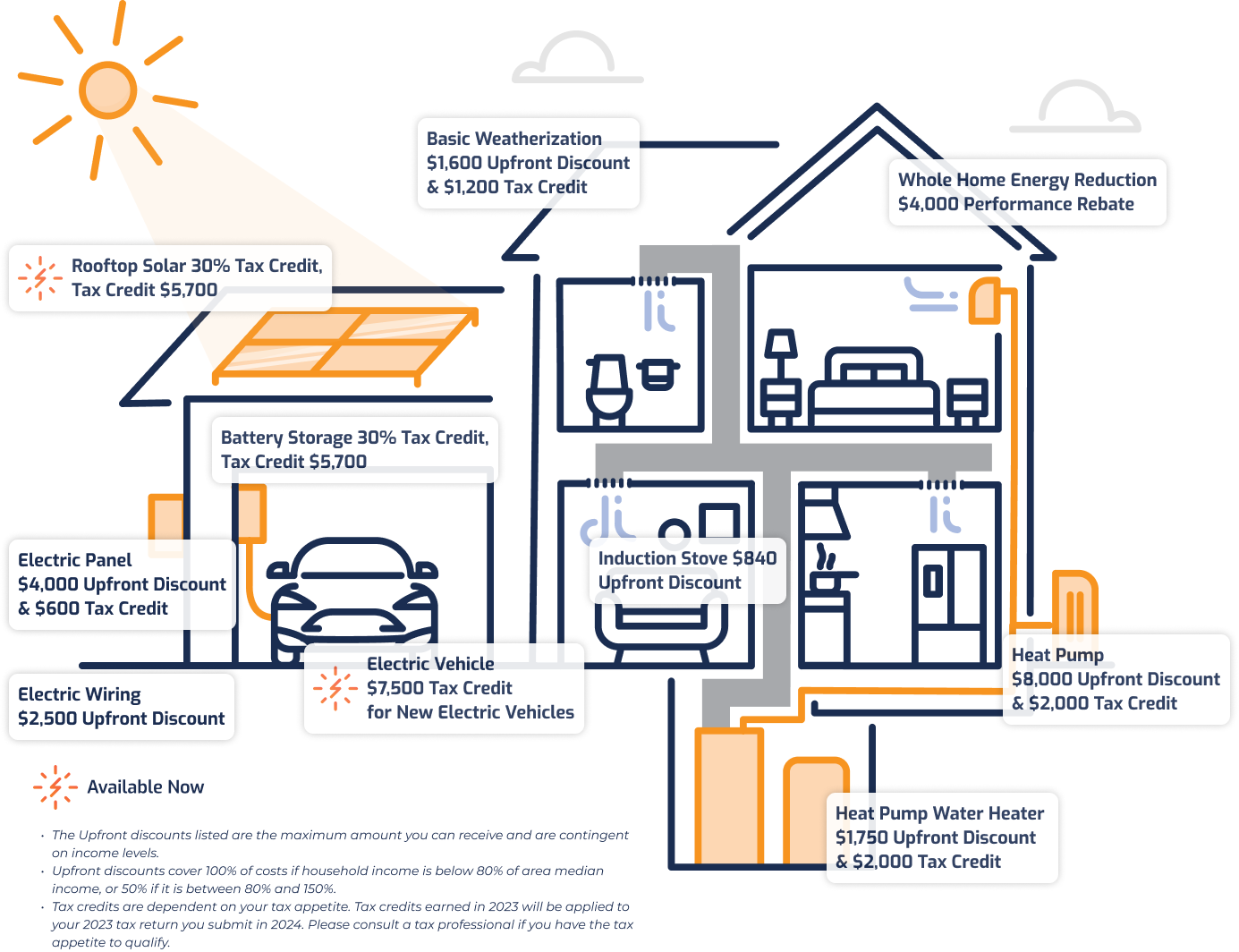

Its home energy offerings include up-front discounts, tax credits and low-cost financing that together provide a substantial pot of money for every household to electrify the machines they rely on — the cars they drive, how they heat the air and water in their homes, cook their food, dry their clothes and get their power — regardless of income level.

Think of the IRA as a free electric bank account with your name on it, because that’s what it is. It’s your own personal fund to help you go electric — swapping out your old, fossil-fueled appliances for new, clean electric ones — over the next ten years.

Running electric appliances and driving EVs were already becoming cheaper than fossil-fueled machines, but the IRA incentives make this financial choice even more compelling by bringing down the up front costs of electric machines themselves. Households will save on average $1,800 a year by going electric.

Want to see how much you can save? Our friends at Rewiring America have created an IRA Savings Calculator!

Potential Savings Based on Income Levels

Key Questions

Is your household income low or moderate?

- The IRA targets the most money to low- and moderate-income households who can least afford to upgrade to electric, yet stand to benefit the most from the lower operating costs.

- “Low income” or “moderate income” is relative to where you live and how big your family is. Compared to the “Area Median Income” (AMI) for your region, any household making less than 80 percent of AMI is considered low income, and any household making between 80 percent and 150 percent of AMI is considered moderate income.

- Low- and moderate-income families are eligible for up-front discounts that can pay for lots of electrification upgrades! Low-income families will have 100 percent of their electrification costs covered up to $14,000, and moderate-income families will have 50 percent of their costs covered (but they can pair the discounts with tax credits for additional savings).

Is your household income too high to qualify?

- If your household income is over 150 percent of your Area Median Income, you won’t qualify for the IRA’s up-front electrification discounts. In the Denver suburbs, that might mean an income over $160,000 for a family of four.

- Instead, these folks can take advantage of the IRA’s electrification tax credits, which will reduce final costs by up to 30 percent!

Do I need to spend a lot to get these incentives?

- In many cases, no! The IRA’s incentives are designed to increase access to clean technology. For households with lower incomes, 100 percent of appliance and installation costs are discounted at purchase, meaning you could install efficient electric appliances at no cost, with no spending.

- Moderate-income households do have to spend in order to access savings, but up to 50 percent of appliance and installation costs can be covered through upfront discounts, and you can use tax credits to cover some of the remaining gap. In most cases, these families will have to spend money either way because they’re replacing a failed or failing machine – the IRA just makes the electric version the most affordable choice.

- Highest income households are not eligible for upfront discounts, so they will have to pay full price for appliances and installation — but tax credits on the back end could recoup around 30 percent of their costs.

- Everyone will likely see lower energy costs going forward.

Do the rebates & tax credits cover installation costs?

- Yes! Along with the purchase costs, installation costs are included too.

When can I access the IRA’s incentives?

- Some tax credits are available now, and others will become available in 2024.

Can I benefit from other incentives in addition to the IRA?

-

Probably! It’s up to your state, local government, and utility to decide if you’re allowed to stack their incentives on top of the IRA’s rebates and tax credits, but we think most of them will allow it.